Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. If you’re going to become an investor, there are a few things you should know — like these formulas.

2 Interest income overview

There are three simple steps to determining the interest liability on a loan note, so you’ll know the total amount you’re paying. That revenue represents interest earned in October, November, and December. The remainder will be recognized in January when the entire amount is paid. Discover the key financial, operational, and strategic traits that make a company an ideal Leveraged Buyout (LBO) candidate in this comprehensive guide. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license.

Financial Accounting

The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance. The effective interest rate is the actual rate of interest paid or received on a loan or investment, taking into account any fees or other charges. how to reduce your tax bill with itemized deductions Non-public entities may elect not to provide certain disclosures required for public entities. While both IFRS 15 and Topic 606 remain substantially converged, certain differences exist that can affect comparability. Here we summarize what we see as the top 10 differences in revenue accounting and disclosures under IFRS Standards and US GAAP.

Standards and frameworks

Let’s also assume Cobalt follows GAAP, which means accrual-based accounting, and the company’s year-end for accounting purposes is December 31. Interest income is a type of income that is earned and accumulated with the passage of time. Likewise, this type of income is usually earned but not yet recorded during the accounting period. Hence, the company needs to account for interest income by properly making journal entry at the end of the period.

What Is the Difference Between Interest Receivable and Interest Revenue?

- In January, the clock starts ticking on the 16th, which means there is no interest accruing during the first 15 days, just the last 16.

- This journal entry is required at the period-end adjusting entry to recognize the interest income earned but not yet recorded during the accounting period.

- If the bank loans out £10,000 at an interest rate of 5%, over the course of a year, the bank would earn £500 in interest revenue.

- We need the frequency of a year because the interest rate is an annual rate and we may not want interest for an entire year but just for the time period of the note.

- The exact method and timing of recognizing interest revenue can vary based on the specifics of the loan agreement and the accounting standards the company follows.

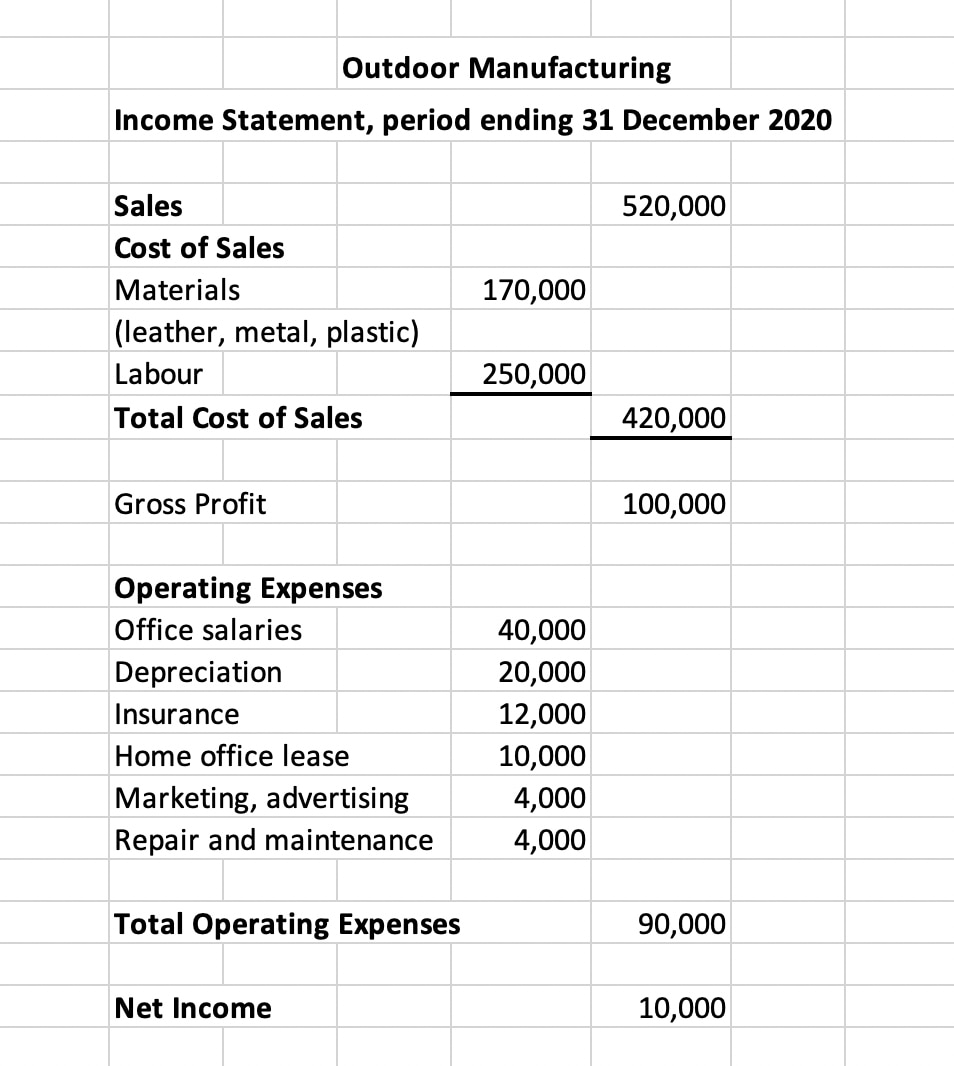

In January, the clock starts ticking on the 16th, which means there is no interest accruing during the first 15 days, just the last 16. Interest accrues all through February, and the note is then due on the 75th day. Most promissory notes have an explicit interest charge, and although some notes are labeled as “zero interest,” there is often a fee built into the note. Interest revenue is classified as an income stream or part of a company’s operating income on the income statement. If a bank lends a large corporation £1 million at an interest rate of 7%, the company would owe the bank £70,000 in interest each year.

How do companies record and report interest revenue and interest receivables?

We need the frequency of a year because the interest rate is an annual rate and we may not want interest for an entire year but just for the time period of the note. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. For example, for long-term construction- and production-type contracts2, a company is allowed to determine the provision for losses at either the contract level (like IFRS Standards) or the performance obligation level (unlike IFRS standards).

Interest revenue is calculated and recorded separately of interest receivable. A note generally creates interest income even though the interest has yet to be paid in cash by the borrower. Amendments to IAS 37 effective for annual reporting periods beginning on or after January 1, 2022 clarify which costs should be used to identify onerous contracts. Interest receivable refers to the interest that has been earned by investments, loans, or overdue invoices but has not actually been paid yet. Put another way, interest receivable is the expected interest revenue a company will receive. As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet.

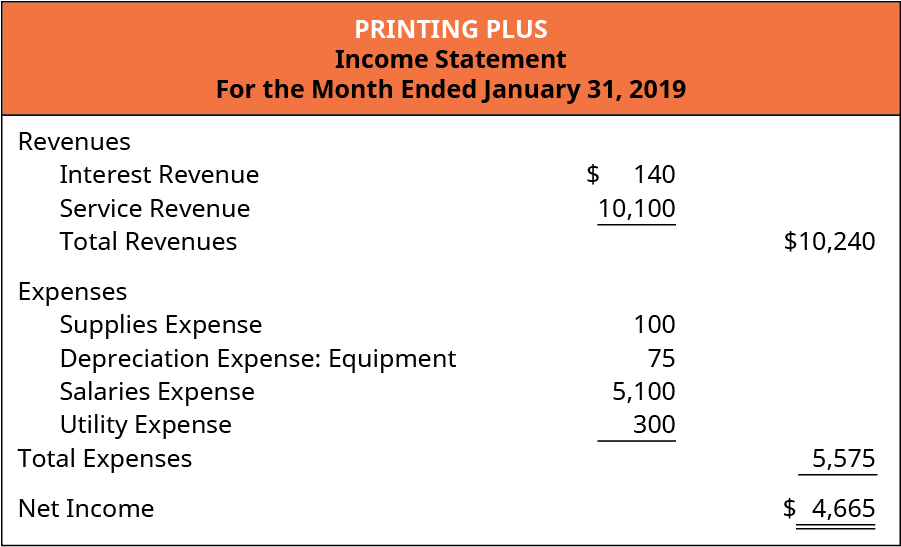

By the end of the first year, Company A has earned interest revenue of $30,000 (6% of $500,000). Even if Company B hasn’t yet paid this interest, under the accrual basis of accounting, Company A can recognize the $30,000 as interest revenue for that year. On the income statement, it would be recorded under revenue, often as a line item called “Interest Revenue” or “Interest Income. Interest revenue, also known as interest income, is the revenue earned by a company or individual from lending money or holding interest-bearing assets. It represents the compensation received for the use of money over a period of time and is a crucial component in the analysis of a company’s financial performance and profitability.

Note that in this calculation we expressed the time period as a fraction of a 360-day year because the interest rate is an annual rate and the note life was days. If the note life was months, we would divide by 12 months for a year. Sometimes a lender or textbook uses this “bank method”—so called because some banks would use 360 days instead of 365 since that actually results in a higher effective interest rate. The main issue with interest revenue is where to record it on the income statement.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Here, we must discuss an important concept – how interest revenue is different from interest receivables. Now, another important question is why interest income is treated as revenue.