On the other hand, when when we earn interest, we call it interest revenue. When Company B pays the interest at the end of the year, Company A will then record a decrease in “Interest 3 tax deductions for renters you don’t want to miss Receivable” and an increase in its cash account on the balance sheet. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

- Although IFRSs have fewer requirements on revenue recognition, the two main revenue recognition standards, IAS 18, Revenue and IAS 11, Construction Contracts, can be difficult to understand and apply.

- The backgroundAs already stated, revenue is a crucial number to users of financial statements in assessing an entity’s financial performance and position.

- The effective interest rate is the actual rate of interest paid or received on a loan or investment, taking into account any fees or other charges.

- As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet.

- Interest income is revenue for the payee and an expense for the payer.

Products and services

Fast forward to 2022, implementation has settled but standard setting has not – for example, the FASB amended its guidance on licenses and on revenue contracts in business combinations. Here we summarize what we see as the current main differences between IFRS 15 and Topic 606. This journal entry is required at the period-end adjusting entry to recognize the interest income earned but not yet recorded during the accounting period. Likewise, if the company doesn’t record the above entry, both total income and total assets will be understated. This journal entry is made to eliminate the receivable that the company has recorded at the adjusting entry of the previous period.

Standards and frameworks

Not all businesses rely in earning interest revenue as their primary source of income. Interest revenue is an earning for the company which is receiving the interest income. However, since one party must pay the interest, the payer’s interest amount is an expense.

Financial Accounting

However, revenue recognition requirements in US generally accepted accounting principles (GAAP) differ from those in International Financial Reporting Standards (IFRSs).Both sets of requirements need improvement. US GAAP comprises broad revenue recognition concepts and numerous requirements for particular industries or transactions that can result in different accounting for economically similar transactions. Although IFRSs have fewer requirements on revenue recognition, the two main revenue recognition standards, IAS 18, Revenue and IAS 11, Construction Contracts, can be difficult to understand and apply. In addition, IAS 18 provides limited guidance on important topics such as revenue recognition for multiple-element arrangements. As the topline, revenue is a key performance indicator for users of financial statements where an understanding of GAAP differences is essential to benchmark against peers. A few years back, IFRS 15 and Topic 606 were introduced to account for revenue from contracts with customers under a common set of principles across IFRS Standards and US GAAP.

The interest income journal entry will increase both the income and assets in the income statement and the balance sheet respectively. Hence, making this journal entry can avoid the understatement of income and assets due to the interest earned. It’s important to note that while interest revenue represents an inflow of cash, it’s different from the principal repayments on loans or the return of the initial investment in bonds, which are also inflows but are not recorded as revenue. Companies often extend credit to other businesses in the form of a note, or a short-term loan. Most notes pay a stated rate of interest, resulting in interest revenue that the lender must record at various points in time until the note comes due. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

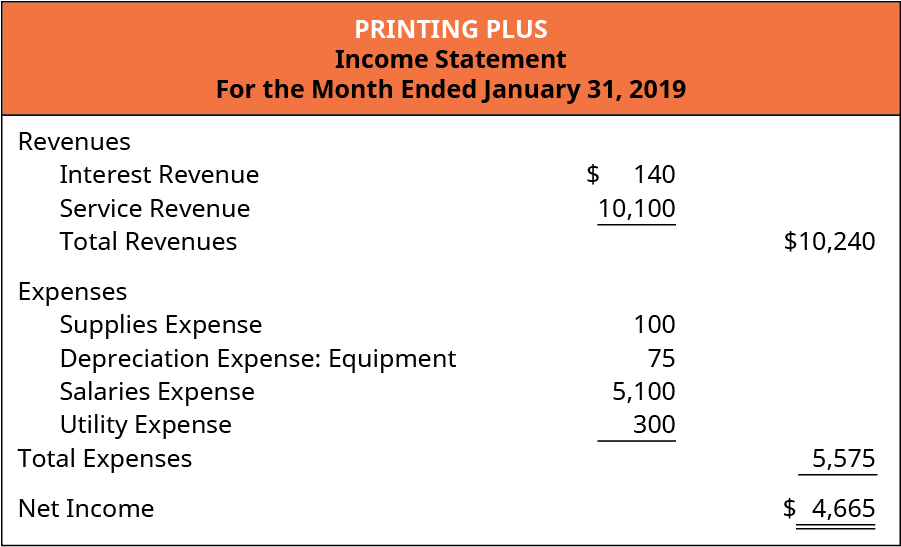

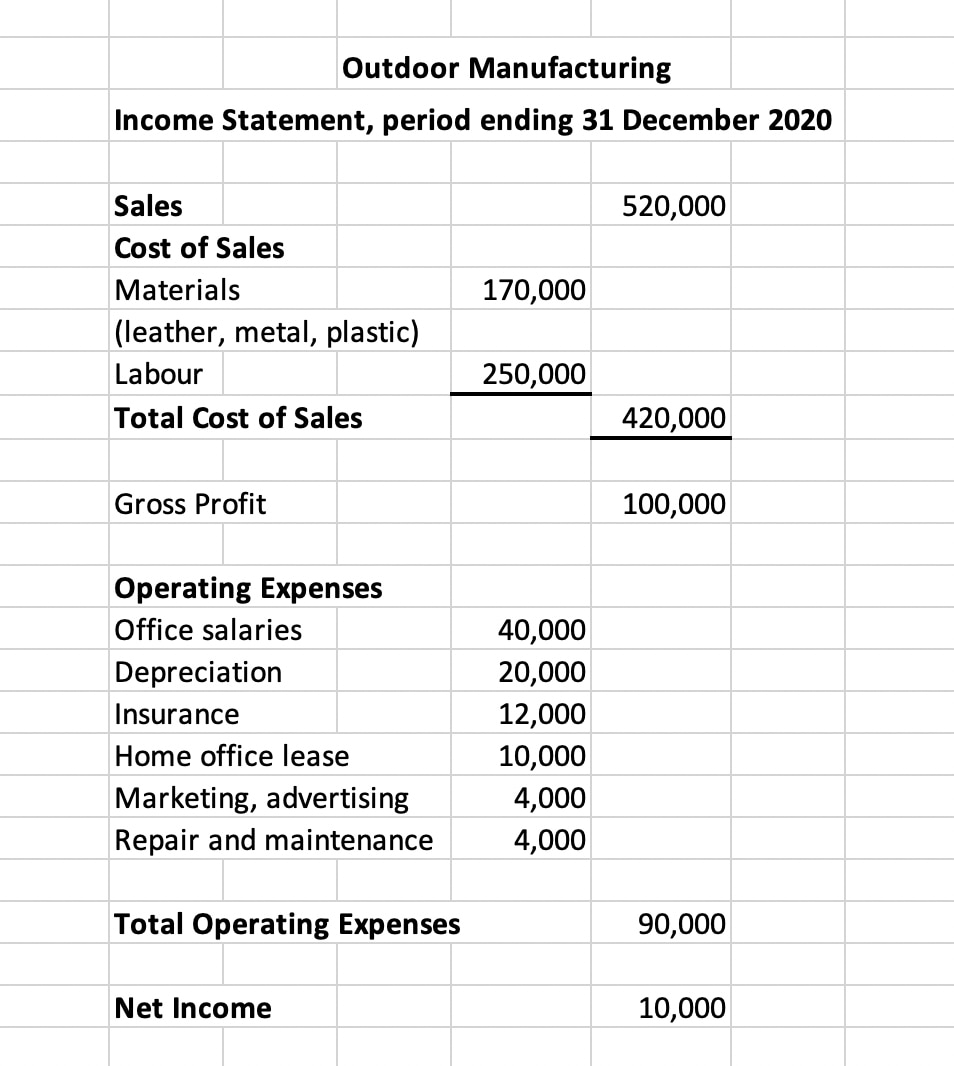

We can know about the interest revenue earned by a company in a given period by looking at the income statement. We earn interest revenue when we have lent money to an entity or invested in an interest-bearing financial asset like a fixed deposit. Customers need to pay interest when they take any type of loan, like a personal loan, mortgage, or auto loan. On the other hand, we receive interest when we lend money or invest in an interest-bearing instrument – for, say, a corporate bond or simply save our money in a bank account.

Meanwhile, under the cash method, interest is not recorded as revenue until it is actually paid. Revenue is recognised when it is probable that future economic benefits will flow to the entity and those benefits can be measured reliably. IAS 18 identifies the circumstances in which those criteria will be met and, therefore, revenue will be recognised. It also provides practical guidance on the application of the criteria. Revenue is measured at the fair value of the consideration received or receivable. If a company follows an accrual basis of accounting, the interest revenue will be recorded in the income statement even if the interest income has not been received.

For example, on June 16, 2020, the company ABC Ltd. make a one-year fixed deposit with the XYZ Bank in the amount of $60,000. The bank will pay a monthly interest of 0.5% per month on the 15th day of each month to the company ABC’s current account. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

The remaining interest would be accrued as revenue in future periods as the interest is earned. There are a few oddities in accounting and finance, the largest being that the financial world typically works on the assumption of a 360-day year, rather than the calendar’s 365-day year. Thus, when calculating interest receivable on a note, it’s important that you calculate interest based on a 360-day year. The maturity date is the date on which a note becomes due and must be paid. Sometimes notes require monthly installments (or payments) but usually, all the principal and interest must be paid at the same time. The wording in the note expresses the maturity date and determines when the note is to be paid.

The exact method and timing of recognizing interest revenue can vary based on the specifics of the loan agreement and the accounting standards the company follows. However, if the company had been using the cash basis of accounting and the cash had not yet been received by the end of the reporting period, no interest revenue would be recorded in that period. A provision is recognized when the unavoidable costs of meeting the obligations under a contract exceed the economic benefits to be received. The unavoidable costs are the lower of the costs of fulfilling the contract and any compensation or penalties from the failure to fulfill it. Interest revenue has a different meaning depending on whether the accrual basis or cash basis of accounting is used. Under the accrual method, all accumulated interest is counted as interest revenue, even if it has not actually been paid yet.